Your Path to Financial Freedom

At Waypoint, we understand the burden that debt can place on individuals and families. That's why we're dedicated to providing effective and compassionate debt relief solutions to help you navigate your journey towards financial freedom. Our mission is simple: to empower you to take control of your finances, alleviate your debt, and build a brighter future.

Trusted Debt Relief Company

Our Commitment to You

At Waypoint, your financial well-being is our top priority. We're committed to providing you with the highest level of service and support as you embark on your journey to financial freedom. Whether you're struggling with credit card debt, medical bills, or student loans, we're here to help you find a way forward.

What We Offer

Debt Consolidation

Consolidate your debts into a single, manageable payment with our debt consolidation services. By combining multiple debts into one, you can streamline your payments and potentially lower your interest rates, making it easier to get back on track financially.

Debt Settlement

If you're struggling to keep up with your debt payments, debt settlement may be an option for you. Our team will negotiate with your creditors on your behalf to reach a settlement amount that's manageable for you, helping you reduce your overall debt burden.

Bankruptcy Assistance

While bankruptcy should be considered a last resort, it can provide a fresh start for those overwhelmed by debt. If bankruptcy is the right option for you, our experienced team will guide you through the process and ensure that you understand your rights and responsibilities every step of the way.

Types of Debt We Handle

At Waypoint we handle various types of debt, including:

Credit Card Debt

Credit card debt is one of the most prevalent forms of consumer debt. High-interest rates and minimum payments can make it challenging to pay off balances, leading to a cycle of debt accumulation. We offer solutions such as debt consolidation and negotiation to help you manage and reduce your credit card debt effectively.

Medical Bills

Unexpected medical expenses can quickly accumulate and create financial strain. We understand the stress that medical debt can cause and work with you to develop strategies for managing and resolving your medical bills, whether through negotiation with healthcare providers or exploring other debt relief options.

Student Loans

Student loan debt can be a significant burden for individuals and families, especially considering the rising costs of higher education. We provide guidance on navigating student loan repayment options, including income-driven repayment plans, loan consolidation, and potential forgiveness programs, to help alleviate the financial strain of student loans.

Personal Loans

Personal loans are often used to cover various expenses, from home improvements to unexpected emergencies. However, high-interest rates and strict repayment terms can make it challenging to stay afloat. Our team can assist you in consolidating or negotiating your personal loan debt to make it more manageable and affordable.

Payday Loans

Payday loans typically come with exorbitant interest rates and short repayment periods, making them a source of financial stress for many individuals. We offer solutions to help you break free from the cycle of payday loan debt, including debt consolidation and negotiation with lenders to reduce the overall amount owed.

IRS Tax Debt

Tax debt owed to the Internal Revenue Service (IRS) can quickly escalate if left unresolved, leading to wage garnishment, asset seizure, and other serious consequences. We provide assistance with negotiating tax debt settlements, setting up payment plans, and navigating IRS procedures to help you resolve your tax obligations efficiently and avoid further penalties.

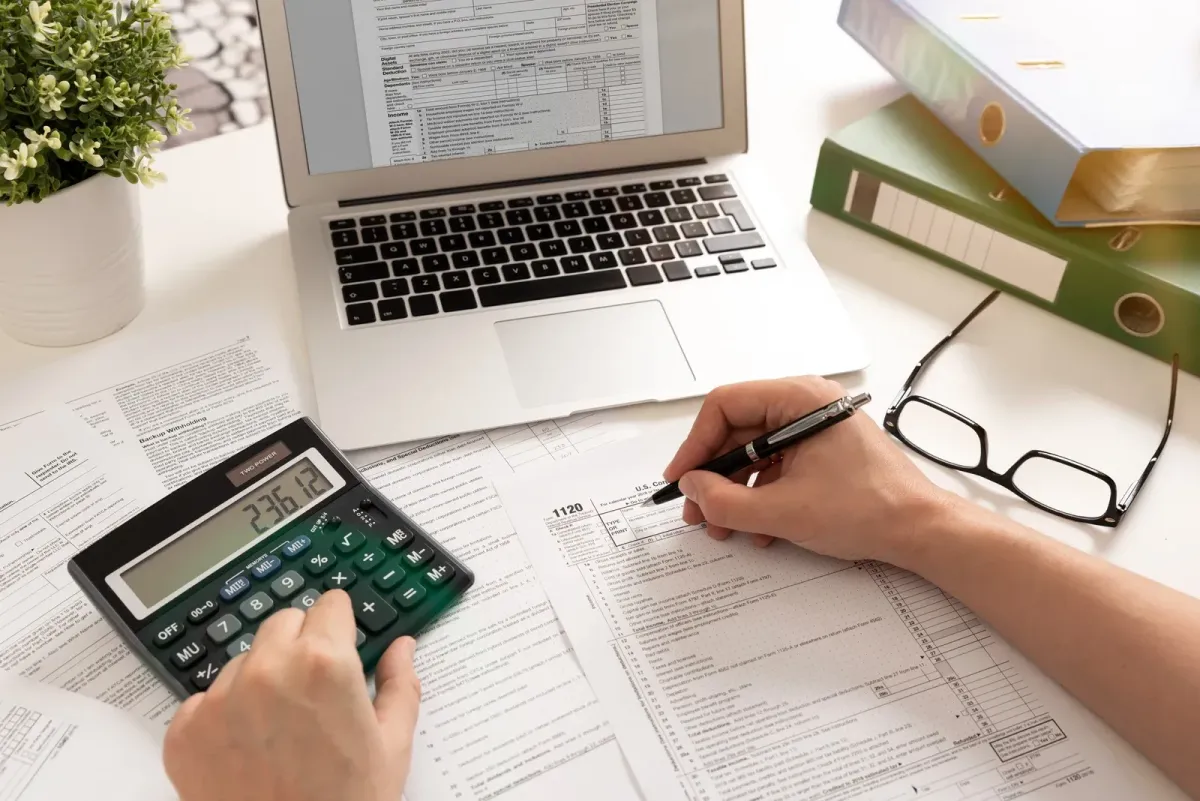

Our Impact by the

Numbers

At Waypoint, we're proud of the milestones we've achieved and the impact we've made. Our numbers reflect our commitment to delivering exceptional financial services, fostering long-term relationships, and driving success for our clients and team.

5,000+

Satisfied Clients

10+

Years of Experience

150+

Professional Employees

Trusted Partners

Why Choose Waypoint?

At Waypoint, we offer more than just debt relief services – we provide a pathway to financial freedom and peace of mind. What sets us apart is our unwavering commitment to our clients' well-being. With a team of seasoned experts boasting years of experience in the financial industry, we have the knowledge and skills to navigate even the most complex financial situations. But it's not just about expertise; it's about compassion and personalized support.

We understand that every individual's financial journey is unique, which is why we take the time to listen, understand, and tailor our solutions to meet your specific needs. Transparency is at the core of everything we do; we'll walk you through your options, ensuring you have a clear understanding of the benefits and potential risks. With Waypoint, you're not just a client – you're a partner on the path to financial success.

Our Clients Speak

Discover the stories of transformation and success from those who have walked the path to financial freedom with Waypoint.

I cannot thank Waypoint enough for their life-changing support. Struggling with overwhelming debt, I felt lost and hopeless. But from the moment I reached out to them, I knew I was in good hands. Their team not only provided expert guidance but also offered unwavering support and encouragement throughout the entire process. Thanks to Waypoint, I now have a clear path to financial freedom and a renewed sense of hope for the future

Sarah T.

Choosing Waypoint was one of the best decisions I've made for my financial well-being. From the initial consultation to the resolution of my debt, their team exceeded my expectations every step of the way. They were not only professional and knowledgeable but also incredibly compassionate and understanding of my situation. Thanks to their expertise and dedication, I can now breathe a sigh of relief knowing that my financial future is in good hands. I highly recommend Waypoint to anyone in need of debt relief services.